Preferred Stock List

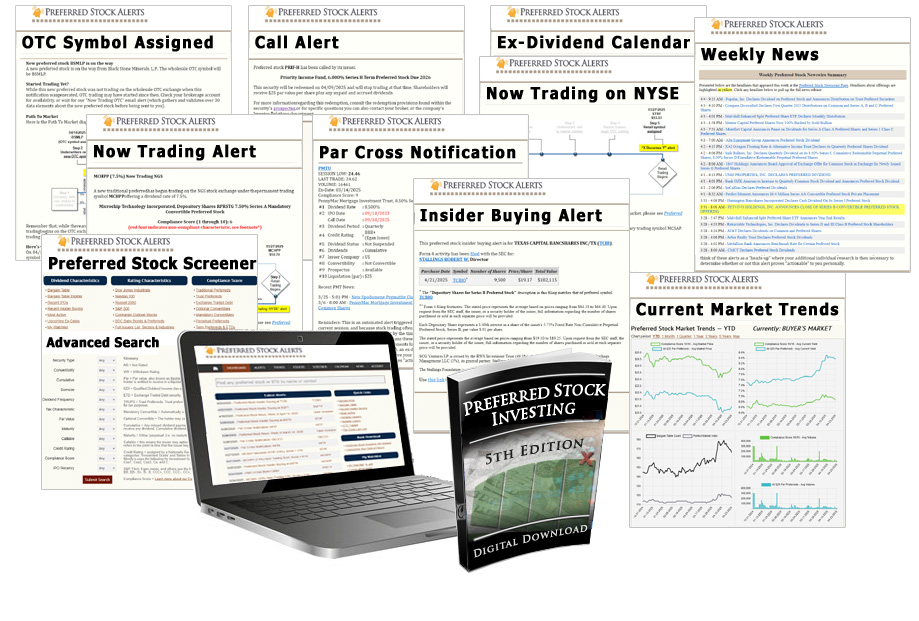

With a current count of 374 issuers across 12 sectors (and 84 industries), our 860 count preferred stock list is an extensive database which notably is also inclusive of our baby bonds lists (i.e. exchange traded debt securities). Preferred stocks and baby bonds rank senior to common stock in a given company's capital structure (with baby bonds ranking senior to preferred stock). Most pay a fixed dividend or coupon, either quarterly (most common), monthly, annually, or semi- annually. All preferred stock lists from our database can be opened in our preferred stock screener tool, which is a handy user interface that displays each preferred stock list in a sortable table format, with dozens of available data columns that can be toggled on and off as desired.Preferred Stock Issuers List (374 Results)

Our preferred stock issuers list covers all of the public and private companies that have issued the preferred stocks and baby bonds in our coverage universe. Our preferred stock and baby bond issuers list is presented in a sortable table format, with the company name of the issuer, ticker symbol (with link to further information if publicly traded — such as how to contact Investor Relations), whether any of the securities in that issuer's preferred stock list have a perfect "Compliance Score" under our ten-point screening criteria (or, score lower than 10 but have fallen onto our popular "Bargain Table List" of the highest quality preferred stocks and baby bonds trading below their par values), as well as sector and industry categorizations.

Unblur / reveal

Basic Materials Preferred Stock List

Below is our preferred stock list for the Basic Materials sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.8 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Basic Materials preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Communication Services Preferred Stock List

Below is our preferred stock list for the Communication Services sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.17 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Communication Services preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Entertainment Preferred Stock List (1 Result)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Consumer Cyclical Preferred Stock List

Below is our preferred stock list for the Consumer Cyclical sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.20 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Consumer Cyclical preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Entertainment Preferred Stock List (1 Result)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Lodging Preferred Stock List (1 Result)

Auto Manufacturers Preferred Stock List (3 Results)

Gambling Preferred Stock List (1 Result)

Luxury Goods Preferred Stock List (1 Result)

Furnishings Fixtures & Appliances Preferred Stock List (1 Result)

Specialty Retail Preferred Stock List (3 Results)

Restaurants Preferred Stock List (2 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Specialty Retail Preferred Stock List (3 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Leisure Preferred Stock List (4 Results)

Specialty Retail Preferred Stock List (3 Results)

Broadcasting - TV Preferred Stock List (1 Result)

Leisure Preferred Stock List (4 Results)

Leisure Preferred Stock List (4 Results)

Residential Construction Preferred Stock List (1 Result)

Restaurants Preferred Stock List (2 Results)

Leisure Preferred Stock List (4 Results)

Department Stores Preferred Stock List (1 Result)

Packaging & Containers Preferred Stock List (1 Result)

Consumer Defensive Preferred Stock List

Below is our preferred stock list for the Consumer Defensive sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.9 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Consumer Defensive preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Entertainment Preferred Stock List (1 Result)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Lodging Preferred Stock List (1 Result)

Auto Manufacturers Preferred Stock List (3 Results)

Gambling Preferred Stock List (1 Result)

Luxury Goods Preferred Stock List (1 Result)

Furnishings Fixtures & Appliances Preferred Stock List (1 Result)

Specialty Retail Preferred Stock List (3 Results)

Restaurants Preferred Stock List (2 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Specialty Retail Preferred Stock List (3 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Leisure Preferred Stock List (4 Results)

Specialty Retail Preferred Stock List (3 Results)

Broadcasting - TV Preferred Stock List (1 Result)

Leisure Preferred Stock List (4 Results)

Leisure Preferred Stock List (4 Results)

Residential Construction Preferred Stock List (1 Result)

Restaurants Preferred Stock List (2 Results)

Leisure Preferred Stock List (4 Results)

Department Stores Preferred Stock List (1 Result)

Packaging & Containers Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Household & Personal Products Preferred Stock List (1 Result)

Discount Stores Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Packaged Foods Preferred Stock List (1 Result)

Beverages - Wineries & Distilleries Preferred Stock List (1 Result)

Energy Preferred Stock List

Below is our preferred stock list for the Energy sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.9 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Energy preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Entertainment Preferred Stock List (1 Result)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Lodging Preferred Stock List (1 Result)

Auto Manufacturers Preferred Stock List (3 Results)

Gambling Preferred Stock List (1 Result)

Luxury Goods Preferred Stock List (1 Result)

Furnishings Fixtures & Appliances Preferred Stock List (1 Result)

Specialty Retail Preferred Stock List (3 Results)

Restaurants Preferred Stock List (2 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Specialty Retail Preferred Stock List (3 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Leisure Preferred Stock List (4 Results)

Specialty Retail Preferred Stock List (3 Results)

Broadcasting - TV Preferred Stock List (1 Result)

Leisure Preferred Stock List (4 Results)

Leisure Preferred Stock List (4 Results)

Residential Construction Preferred Stock List (1 Result)

Restaurants Preferred Stock List (2 Results)

Leisure Preferred Stock List (4 Results)

Department Stores Preferred Stock List (1 Result)

Packaging & Containers Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Household & Personal Products Preferred Stock List (1 Result)

Discount Stores Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Packaged Foods Preferred Stock List (1 Result)

Beverages - Wineries & Distilleries Preferred Stock List (1 Result)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas E&P Preferred Stock List (1 Result)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Financial Preferred Stock List

Below is our preferred stock list for the Financial sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.3 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Financial preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Entertainment Preferred Stock List (1 Result)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Lodging Preferred Stock List (1 Result)

Auto Manufacturers Preferred Stock List (3 Results)

Gambling Preferred Stock List (1 Result)

Luxury Goods Preferred Stock List (1 Result)

Furnishings Fixtures & Appliances Preferred Stock List (1 Result)

Specialty Retail Preferred Stock List (3 Results)

Restaurants Preferred Stock List (2 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Specialty Retail Preferred Stock List (3 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Leisure Preferred Stock List (4 Results)

Specialty Retail Preferred Stock List (3 Results)

Broadcasting - TV Preferred Stock List (1 Result)

Leisure Preferred Stock List (4 Results)

Leisure Preferred Stock List (4 Results)

Residential Construction Preferred Stock List (1 Result)

Restaurants Preferred Stock List (2 Results)

Leisure Preferred Stock List (4 Results)

Department Stores Preferred Stock List (1 Result)

Packaging & Containers Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Household & Personal Products Preferred Stock List (1 Result)

Discount Stores Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Packaged Foods Preferred Stock List (1 Result)

Beverages - Wineries & Distilleries Preferred Stock List (1 Result)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas E&P Preferred Stock List (1 Result)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Property & Casualty Insurance Preferred Stock List (1 Result)

Money Center Banks Preferred Stock List (1 Result)

Investment Brokerage - National Preferred Stock List (1 Result)

Financial Services Preferred Stock List

Below is our preferred stock list for the Financial Services sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.420 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Financial Services preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Entertainment Preferred Stock List (1 Result)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Lodging Preferred Stock List (1 Result)

Auto Manufacturers Preferred Stock List (3 Results)

Gambling Preferred Stock List (1 Result)

Luxury Goods Preferred Stock List (1 Result)

Furnishings Fixtures & Appliances Preferred Stock List (1 Result)

Specialty Retail Preferred Stock List (3 Results)

Restaurants Preferred Stock List (2 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Specialty Retail Preferred Stock List (3 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Leisure Preferred Stock List (4 Results)

Specialty Retail Preferred Stock List (3 Results)

Broadcasting - TV Preferred Stock List (1 Result)

Leisure Preferred Stock List (4 Results)

Leisure Preferred Stock List (4 Results)

Residential Construction Preferred Stock List (1 Result)

Restaurants Preferred Stock List (2 Results)

Leisure Preferred Stock List (4 Results)

Department Stores Preferred Stock List (1 Result)

Packaging & Containers Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Household & Personal Products Preferred Stock List (1 Result)

Discount Stores Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Packaged Foods Preferred Stock List (1 Result)

Beverages - Wineries & Distilleries Preferred Stock List (1 Result)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas E&P Preferred Stock List (1 Result)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Property & Casualty Insurance Preferred Stock List (1 Result)

Money Center Banks Preferred Stock List (1 Result)

Investment Brokerage - National Preferred Stock List (1 Result)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Capital Markets Preferred Stock List (27 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Real Estate - Development Preferred Stock List (2 Results)

Specialty Finance Preferred Stock List (43 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Fund Preferred Stock List (16 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Insurance - Life Preferred Stock List (20 Results)

REIT - Mortgage Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Life Preferred Stock List (20 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Credit Services Preferred Stock List (22 Results)

Energy Preferred Stock List (1 Result)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Fund Preferred Stock List (16 Results)

Insurance - Life Preferred Stock List (20 Results)

Fund Preferred Stock List (16 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Savings & Cooperative Banks Preferred Stock List (2 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Capital Markets Preferred Stock List (27 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Global Preferred Stock List (34 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Savings & Cooperative Banks Preferred Stock List (2 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance Brokers Preferred Stock List (1 Result)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Fund Preferred Stock List (16 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Fund Preferred Stock List (16 Results)

Healthcare Preferred Stock List

Below is our preferred stock list for the Healthcare sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.12 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Healthcare preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Entertainment Preferred Stock List (1 Result)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Lodging Preferred Stock List (1 Result)

Auto Manufacturers Preferred Stock List (3 Results)

Gambling Preferred Stock List (1 Result)

Luxury Goods Preferred Stock List (1 Result)

Furnishings Fixtures & Appliances Preferred Stock List (1 Result)

Specialty Retail Preferred Stock List (3 Results)

Restaurants Preferred Stock List (2 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Specialty Retail Preferred Stock List (3 Results)

Auto Manufacturers Preferred Stock List (3 Results)

Leisure Preferred Stock List (4 Results)

Specialty Retail Preferred Stock List (3 Results)

Broadcasting - TV Preferred Stock List (1 Result)

Leisure Preferred Stock List (4 Results)

Leisure Preferred Stock List (4 Results)

Residential Construction Preferred Stock List (1 Result)

Restaurants Preferred Stock List (2 Results)

Leisure Preferred Stock List (4 Results)

Department Stores Preferred Stock List (1 Result)

Packaging & Containers Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Farm Products Preferred Stock List (5 Results)

Household & Personal Products Preferred Stock List (1 Result)

Discount Stores Preferred Stock List (1 Result)

Farm Products Preferred Stock List (5 Results)

Packaged Foods Preferred Stock List (1 Result)

Beverages - Wineries & Distilleries Preferred Stock List (1 Result)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas E&P Preferred Stock List (1 Result)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Refining & Marketing Preferred Stock List (2 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Oil & Gas Midstream Preferred Stock List (6 Results)

Property & Casualty Insurance Preferred Stock List (1 Result)

Money Center Banks Preferred Stock List (1 Result)

Investment Brokerage - National Preferred Stock List (1 Result)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Capital Markets Preferred Stock List (27 Results)

Credit Services Preferred Stock List (22 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Real Estate - Development Preferred Stock List (2 Results)

Specialty Finance Preferred Stock List (43 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Fund Preferred Stock List (16 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Insurance - Life Preferred Stock List (20 Results)

REIT - Mortgage Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Life Preferred Stock List (20 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Credit Services Preferred Stock List (22 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Credit Services Preferred Stock List (22 Results)

Energy Preferred Stock List (1 Result)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Life Preferred Stock List (20 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Fund Preferred Stock List (16 Results)

Insurance - Life Preferred Stock List (20 Results)

Fund Preferred Stock List (16 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Life Preferred Stock List (20 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Life Preferred Stock List (20 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Capital Markets Preferred Stock List (27 Results)

Fund Preferred Stock List (16 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Diversified Preferred Stock List (15 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Savings & Cooperative Banks Preferred Stock List (2 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Fund Preferred Stock List (16 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Insurance - Reinsurance Preferred Stock List (11 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Capital Markets Preferred Stock List (27 Results)

Asset Management Preferred Stock List (105 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Asset Management Preferred Stock List (105 Results)

Asset Management Preferred Stock List (105 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Capital Markets Preferred Stock List (27 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Property & Casualty Preferred Stock List (24 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Capital Markets Preferred Stock List (27 Results)

Insurance - Life Preferred Stock List (20 Results)

Credit Services Preferred Stock List (22 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Global Preferred Stock List (34 Results)

Capital Markets Preferred Stock List (27 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Banks - Global Preferred Stock List (34 Results)

Credit Services Preferred Stock List (22 Results)

Banks - Global Preferred Stock List (34 Results)

Asset Management Preferred Stock List (105 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Global Preferred Stock List (34 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Savings & Cooperative Banks Preferred Stock List (2 Results)

Specialty Finance Preferred Stock List (43 Results)

Banks - Regional - US Preferred Stock List (98 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Insurance Brokers Preferred Stock List (1 Result)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Specialty Finance Preferred Stock List (43 Results)

Fund Preferred Stock List (16 Results)

Banks - Global Preferred Stock List (34 Results)

Specialty Finance Preferred Stock List (43 Results)

Fund Preferred Stock List (16 Results)

Medical Devices Preferred Stock List (2 Results)

Long-Term Care Facilities Preferred Stock List (2 Results)

Medical Distribution Preferred Stock List (1 Result)

Medical Care Facilities Preferred Stock List (1 Result)

Pharmaceutical Retailers Preferred Stock List (1 Result)

Biotechnology Preferred Stock List (4 Results)

Biotechnology Preferred Stock List (4 Results)

Medical Care Preferred Stock List (1 Result)

Medical Devices Preferred Stock List (2 Results)

Biotechnology Preferred Stock List (4 Results)

Long-Term Care Facilities Preferred Stock List (2 Results)

Biotechnology Preferred Stock List (4 Results)

Industrials Preferred Stock List

Below is our preferred stock list for the Industrials sector, which as with all of our other preferred stock lists is also inclusive of any baby bonds (exchange traded debt securities), traditional preferreds, trust preferreds, and 3rd party trust preferreds.41 Results. Compliance Score: non-compliant features highlighted in ■ background. Baby bonds are denoted in ■ background.

Unblur / reveal

Within the Industrials preferred stock list, you can also explore sub-lists by industry:

Coking Coal Preferred Stock List (2 Results)

Coking Coal Preferred Stock List (2 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Oil & Gas Equipment & Services Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Gold Preferred Stock List (1 Result)

Specialty Chemicals Preferred Stock List (4 Results)

Specialty Chemicals Preferred Stock List (4 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)

Telecom Services Preferred Stock List (16 Results)